How to estimate the Cost to Develop fintech app

by: XpertsApp Team

-6961 views

Many different technologies support different fintech, business models. They consist of robotic processing automation, AI, machine learning, and blockchain technology, among other big data applications (RPA). More than 60% of bank executives think FinTech will have a global impact on wallets and digital payments. Virtual currency is proliferating. It is quick, dependable, secure, and convenient. As a result, demand for fintech app development services is growing.

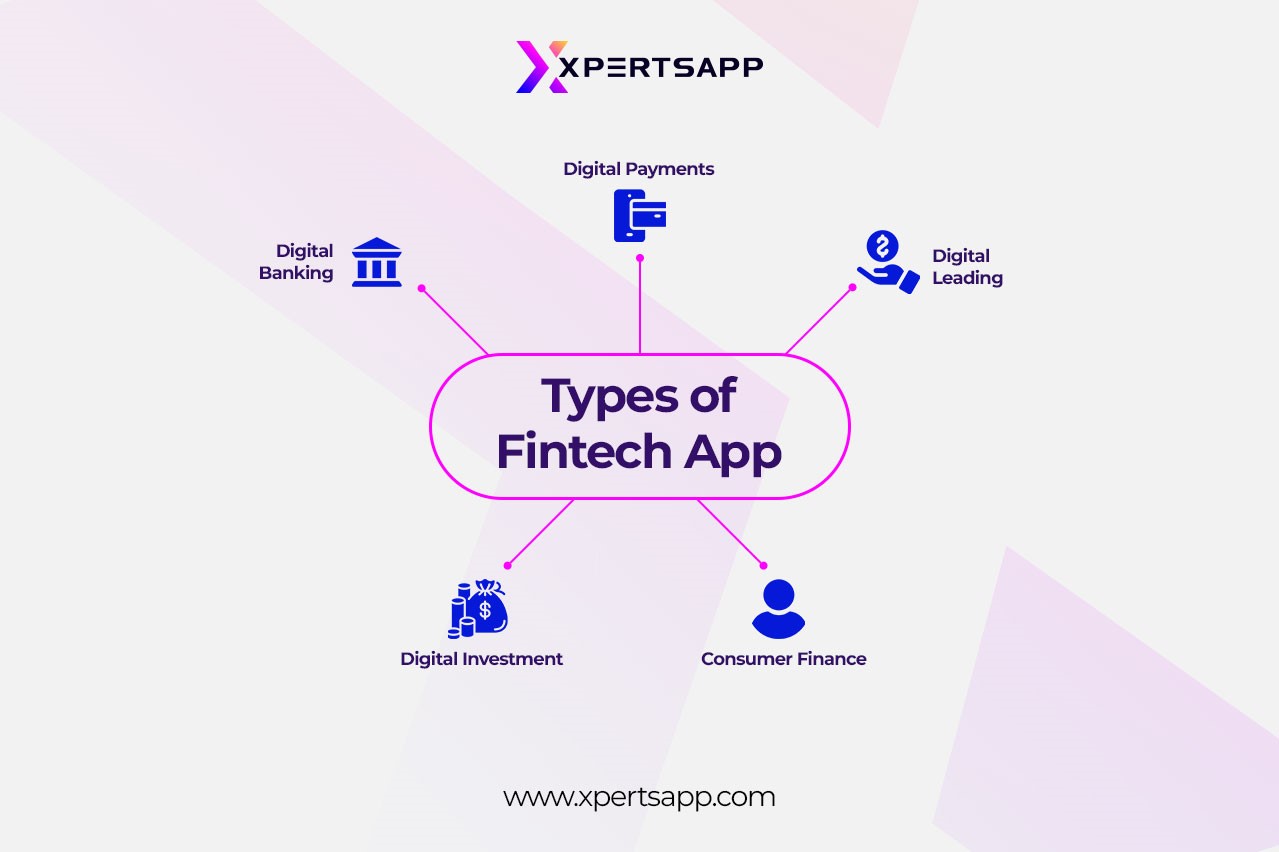

FinTech has many different applications. There are apps available for online banking, wealth management, stock trading, personal finance, cryptocurrency trading, insurance policies, and many other things. As a result, different FinTech applications have additional costs. FinTech app development services are expanding dramatically as a result of the proliferation of Blockchain implementations. The way that FinTech functions are also changing thanks to AI, ML, and big data. Currently, creating Fintech apps is more concerned with providing a customized experience for which Xpertsapp as a renowned firm, hire fintech app developers that excel in their acquisitions to develop an application that delivers precisely what you ask for.

So how does one determine the cost of developing a FinTech app? The kind of application, features, teams, places, and other factors all play a role. Let’s take a closer look at the main elements.

Top applications made with fintech app development

These days there are multiple applications that use fintech as a technology update some of those applications are:

Banking Apps

- All financial solutions are offered online by digital or Internet banking applications. Everything may be done online, from creating an account to applying for loans. Every question a person has can be answered by the app, so they don’t need to go to the branch.

- With regards to the updates, fintech has provided to the banking sector has increased growth rate of individuals using online banking systems for every special payment.

Investment App

- The opportunity to invest in various instruments is provided by these apps. Some businesses, like mutual funds, could have their personal investment software the best Example these days would definitely be Binance one of the most known Application these days around the globe for Digital currency investments.

- Trading applications, cryptocurrency exchanges, and other tools are examples of investing solutions.

Apps for Personal Finance:

- Customers can manage their finances thanks to these options. People may keep track of their earnings and outlays, create a budget, and make sure they stick to it.

- These apps serve as an individual journals for keeping track of all financial transactions.

- Many businesses provide insurance applications for processing claims, resolving consumer inquiries, comparing policies, etc. One of the leading US insurance apps “BREACH (crypto shield)” is a well-known FinTech application example in the insurance industry working as an insurance for your crypto investments.

In addition, there are other more FinTech app categories that are dominating. The newest developments include e-portals, digital wallets, and more. Apps for one-stop buying, such as Amazon Pay and PayTM, are becoming more common.

Features to consider when determining the cost or hire fintech app developers

The features have a significant impact on how much a firm FinTech application costs. But different functionalities are required for different kinds of applications. The features of an insurance app will be different from those of a personal finance app.

However, there are a few key elements that any app must have. All users of different apps use them. They aid in the cost comparison of varying FinTech app kinds.

Personalization Options:

- Each user today needs their own home screen. The aim is to establish preferences.

- Apps with personalization capabilities will be the primary emphasis of a FinTech application development firm. It will also contain advice and recommendations.

Profile management:

- Every user should have the ability to manage their profile. They must be able to connect wallets, add bank accounts, change their usernames, change their profile pictures, and more.

- It gives customers comprehensive information about their financial profile.

User registration and login

- These are the fundamental features of every FinTech application. A user profile is crucial since FinTech allows users to save and record data.

- Consequently, a registration and login functionality is required for the application.

Digital assistant:

- Everyone anticipates the application to have a virtual assistant or chatbot. By providing solutions to frequent queries, it offers speedy query resolution.

- Additionally, chatbots direct consumers to the appropriate representatives when they are unable to help.

Reminders & Updates:

- Every user wants alerts about deals and offers. However, notifications regarding transactions, renewals, reminders, discounts, and other events are provided by FinTech applications.

- The app needs to provide updates on goods and services.

These are the five essential components that each FinTech app must have. In addition, data analytics, security, and other aspects can give FinTech app cost estimates while you think to hire fintech app developers.

Let’s now examine how to calculate the cost of developing a fintech app.

How to estimate the cost of fintech app developers?

We now comprehend that the types and features of a FinTech app significantly affect its costs. Companies, however, are seeking more when they hire FinTech developers for either Android/IOS or Hybrid App development. A software development firm will actually charge a different rate than a freelancer or an internal FinTech app developer.

Consider the following factors when determining the price of developing a fintech application or thinking about hiring fintech app developers:

App category:

- The type of FinTech application to design must be understood. A simple personal finance software with a straightforward user interface and features will cost between $30k and $50k. A digital banking app, though, might exceed $100k.

- They are more extensive and more intricate. Therefore, it’s crucial to comprehend the type of app.

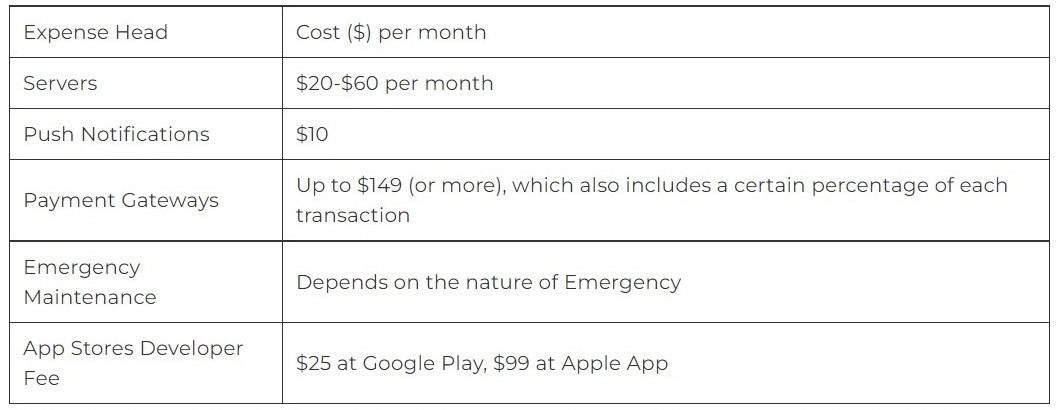

Maintenance cost

- First things first, maintenance expenditures must be taken into account! It is a continuous procedure. Many businesses disregard entirely maintenance costs. Fintech app developers are experts and aren’t easily found. Therefore, maintenance cost is a must to keep up the application working efficiently and being user-friendly.

- On the other hand, they are very expensive over time. Maintenance costs will rise as the application scales.

Team Size:

- The size of the team also affects how much FinTech apps cost. Depending on the complexity of the project, an enterprise software development business could provide a team. Costs will rise as the team size increases.

- Some projects deploy 2-3 teams, which costs more than $150k.

Duration of delivery:

- Finally, remember that time is of the essence. The cost to develop an app will be significantly influenced by the delivery time. Increased teamwork will be necessary for rapid prototyping and development.

- As a result, the team that rarely works on the project with a longer delivery timeframe will incur a higher cost.

Therefore, the aforementioned features determine the cost to develop fintech apps. The price will be between $30,000 and $50,000 for simplistic, effective software with a simple and direct UI. FinTech app prices for business can range from $50,000 to $250,000 as the complexity rises.

Conclusion

Calculating the cost of FinTech development is a complex undertaking. There are numerous parameters to consider. On the other hand, a software development business can help you save a ton of time, money, and effort. Leading developer of FinTech apps, XPERTSAPP has experience with various FinTech app types to deliver the best in your budget within the market’s competitive delivery time.